Set a Goal, Make a Plan and Save with Military Saves!

Saving money, improving your financial life, building wealth. It all starts when you set a goal and make a plan to reach that goal. So what is your goal? Set up an emergency cash fund? Get out of debt? Make a down payment on a car or home? Sock away money for college or retirement?

Take the Military Saves Pledge

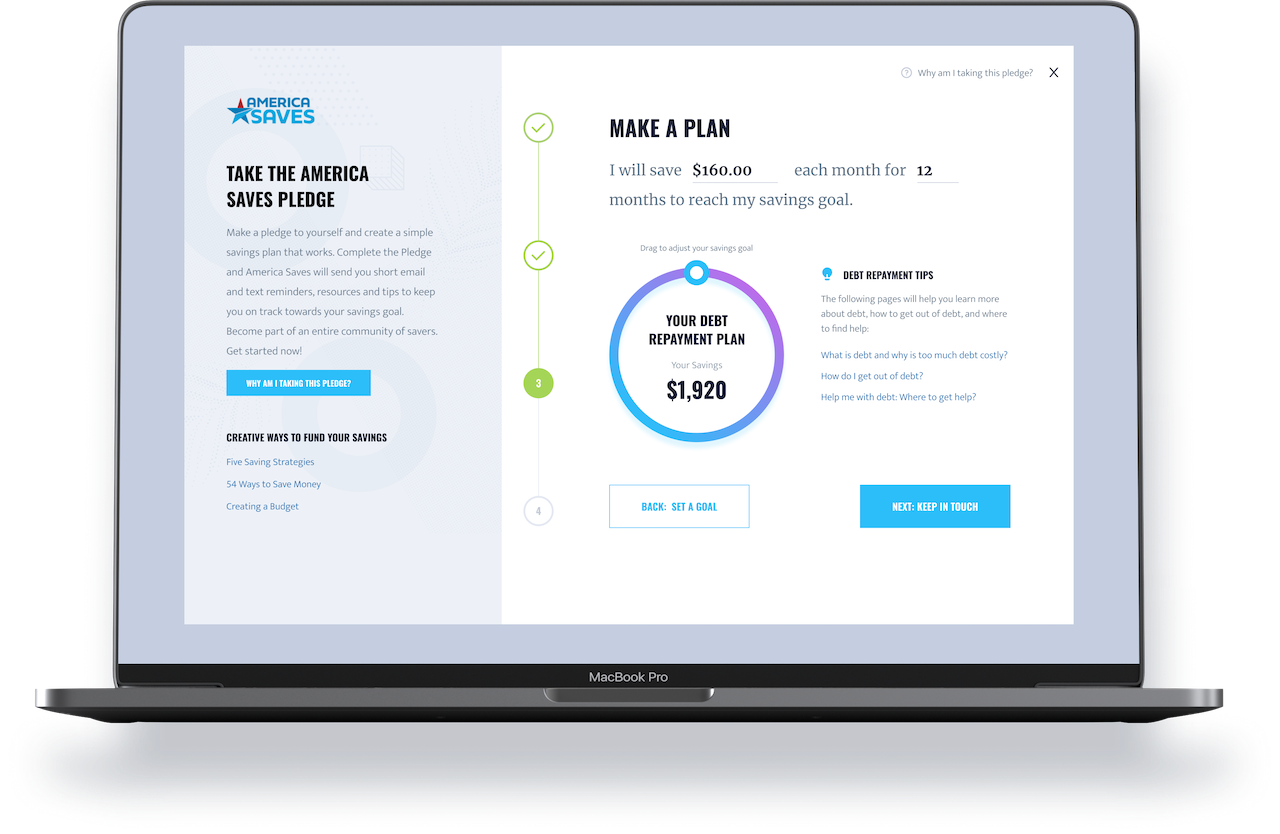

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Military Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now! Please use a CIVILIAN email address.

Creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Military Saves Pledge is a pledge to yourself to start a savings journey and Military Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Military Saves will be right beside you the whole way! You will soon receive an email from the Military Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

WHAT ARE YOU SAVING FOR?

Depending on your goal your approach to saving changes! Choose a topic to explore and learn more about how to save successfully and effectively in that specific area.

Do you have a saving tip or story you want to share with us?

If we feature your story or tip, you get $50.

TAKE THE MILITARY SAVES PLEDGE

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Military Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now!

Take the Military Saves Pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Military Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now! Please use a CIVILIAN email address.

Creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Military Saves Pledge is a pledge to yourself to start a savings journey and Military Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Military Saves will be right beside you the whole way! You will soon receive an email from the Military Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

Savings Insights

10.02.2023 By Krystel Spell

HOW SERVICE MEMBERS CAN PREPARE FOR A GOVERNMENT SHUTDOWN

Facing the prospect of a government shutdown naturally brings a wave of uncertainty. When discussions arise about potential disruptions in pay, it’s common to think about the state of your finances, contemplate how long you could sustain on your savings, or wonder how to manage if you haven’t yet established a savings account. Here at Military Saves, we are dedicated to fostering a shame-free, empowering environment, especially during times like this, to assist you in maintaining financial well-being and peace of mind.

08.01.2023

4 WAYS SERVICE MEMBERS CAN JUMPSTART THEIR EMERGENCY FUND

Being prepared for the unexpected is vital for military individuals and their families. By having an emergency savings fund, you create a financial safety net that brings peace of mind. It not only protects you during tough times, but also allows you to navigate the challenges and expenses that come with relocating to a new duty station and seize exciting opportunities without financial stress .

By Krystel Spell

Renting 101 For Service Members and Their Families

Transitioning between homes is a frequent reality for military families. With each move comes the decision to buy or rent a new residence.

05.25.2023 By Krystel Spell

Finding the Right Lender for Military Home Buyers

Embarking on the path to homeownership is an exciting endeavor for anyone, but as a military homebuyer, finding the right lender is important. With unique challenges and benefits specific to the military community, it's essential to partner with a lender who understands your needs and can guide you through the process. Below are tips to help you find the perfect lender for your military homeownership journey.

05.18.2023 By Krystel Spell

6 Money Saving Reasons You Should Use the VA Loan When Buying A Home

The VA loan program is a great benefit of military service that provides many money saving options and empowers military members to achieve their dreams of homeownership.

12.20.2022 By Amy Miller, AFC® and Krystel Spell

FOLLOW THE 30/40/30 RULE TO MAKE THE MOST OF A MILITARY WINDFALL

Windfalls come in many forms – inheritance, tax return, military bonus, military backpay or maybe a lottery winning. Sometimes they are expected, and sometimes they are not. Either way, deciding what to do with extra money can be challenging and leaves many not knowing how much to spend and how much to save, especially when trying to do the right thing and make the most of the additional funds.

12.08.2022 By Amy Miller, AFC® and Krystel Spell

WHAT YOU NEED TO KNOW ABOUT SETTING A MONTHLY MILITARY MONEY DATE

A money date is an opportunity to talk openly and honestly about your day-to-day finances and your short- and long-term financial goals

07.21.2022 By Krystel Spell

6 Steps to Establishing a Spending and Savings Plan for Your Military Lifestyle

The finances of military service members and their families are unique because not only must you account for regular everyday life expenses, but also plan for ever-changing circumstances like PCS moves, deployments, and fluctuating income.

07.21.2022 By Krystel Spell

10 Ways To Earn Extra Money For Military Families

You’ve created a Spending and Savings Plan, aka “a budget,” and realized you need to increase the income coming into your household. The problem is, you’re already working full time, or taking on a second job outside the home isn’t possible.

06.01.2022 By Krystel Spell

A List of Unexpected Costs Associated with Buying a Home

Don't get caught with unexpected costs! Here's a list of unexpected costs that you may not be aware of of when buying a home.

Partner Resource Packets

We know that the hard work of getting people to change their financial behavior takes time, which is why Military Saves wants to assist your efforts to encourage financial action and savings behavior change throughout the year.

View the Latest Partner Resource Packets

Want to share savings messages? Our Partner Resources Packets include blog, social media, and other content.

By MyArmyBenefits Team

Life After Retirement: Will You Have Enough?

This month we are highlighting a partner resource. MyArmyBenefits is the U.S. Army’s official benefits website and is geared toward all components: Active, Guard, and Reserve.

Like Us on Facebook

Follow Us on Twitter

General - TSP2

Participate in the Thrift Savings Plan (TSP) - a retirement savings and investment plan for Federal employees and members of the Uniformed Services. It offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans. More info at tsp.gov

Want to receive the latest info from Military Saves?

For Savers

For Savers

For Organizations

For Organizations