Make Saving Automatic

It can be difficult to find the money to put aside for savings, but there is an easy way to save money without ever missing it: make your savings automatic.

Saving automatically—through an allotment or automatic transfer of funds—to a short-term or long-term savings account is the best way to save. Why? Because you don’t have to think about it. Set it and forget it because it’s automatic! So, whether it comes to saving for your emergency fund, paying off a debt or investing in your retirement, set your savings on autopilot today!

How to save automatically

- Set up an allotment from your pay via myPay. Have an amount go to an account that is separate from your regular checking account.

- Use your banking institution’s bill pay system to automatically transfer money from your checking account to a separate savings account.

Why automatic savings works

- Saving automatically makes it easier to save because you don’t have to think about how much to save or take any additional steps.

- It’s tempting to spend money when it’s readily available. If you don’t see the money, you are less likely to miss it.

I don’t have enough money to save

Everyone has the ability to save. At Military Saves, we say “Start Small, Think Big.” You can start with only $10 a week or month, but you have to start somewhere. When you get extra income, add that money to your account as well. Try saving:

- A portion of your tax return

- Deployment or other special pay

- Birthday or holiday money

- Money from items you've sold (garage sales and consignment)

Over time, your deposits will add up. Even small amounts of savings can help you in the future.

Do you save automatically? Let us know on our Facebook page.

Take the Military Saves Pledge

Want inspiration and motivation on your savings journey? Take the Military Saves Pledge today and create a simple personal savings plan that works!

Take the Veteran Saves Pledge

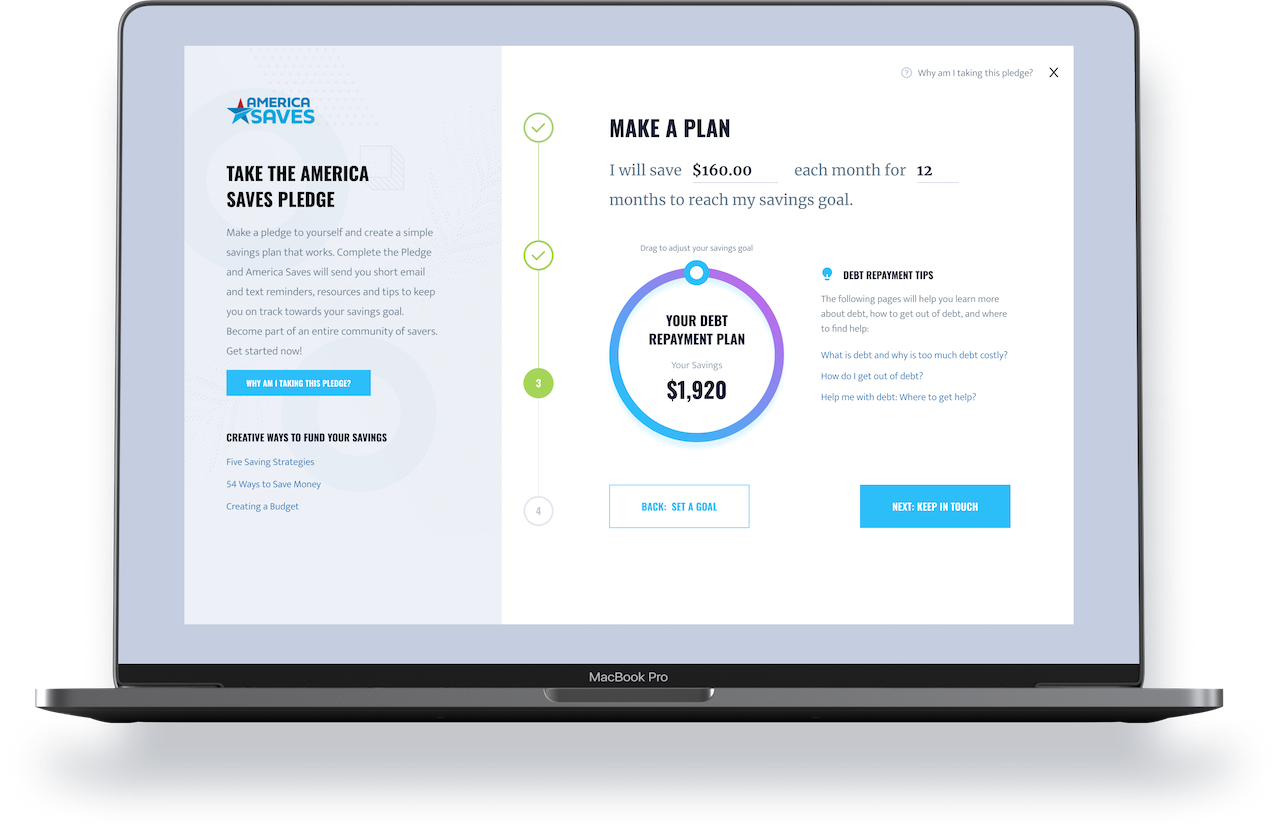

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now! Please use a CIVILIAN email address.

Creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Veteran Saves Pledge is a pledge to yourself to start a savings journey and Veteran Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Veteran Saves will be right beside you the whole way! You will soon receive an email from the America Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

General - Save 1%

#Save just 1% of your income this year and grow $250-$500 in savings by the end of the year depending on your salary: http://ow.ly/tvMwQ

Check out savings journeys from savers just like you

Living the Dream: This Military Couple Retired Early

03.18.2021

“Continuous dedication to financial peace pays off,” shares military couple, Denise and Jim. They would know, because at ages 52 and 53, they are already retired. The couple enjoyed life as an Army family for 32 and a half years and started planning for retirement decades ago. Denise shares, “We are not working a paid job, but are volunteering and meeting some personal fitness goals and enjoying some time together after many years spent geographically apart. It can be done!”

Setting a Goal Leads to Success

05.24.2019

Growing up, Marisa’s dad had always talked about saving first, but she said she didn’t really internalize...

How Smart Financial Decisions Can Create Opportunities

11.22.2019 By Stephen Ross, America Saves Program Coordinator

Involving Kids in Family Finances

04.19.2019

One of the best lessons we can share with our kids is about money. By middle school, kids should have a g...

Building a Six-Figure Savings While Enjoying Life

11.13.2020

Does the idea of saving up hundreds of thousands of dollars seem impossible? How about doing it while sti...

or

If we feature you in our newsletter, you get $50.