Saving with U.S. Savings Bonds

Helping People Save - Ready.Save.Grow. is a U.S. Department of the Treasury initiative to help people save and take control of their future.

Setting money aside for the future is an important step toward reaching your long-term goals, whether that means saving for your child’s college education or preparing for a more comfortable retirement. Learn how convenient saving can be with Treasury securities.

Treasury savings options are:

- Affordable. You don’t need a lot of money to save with Treasury savings options. You can purchase a savings bond for just $25 and other Treasury securities starting at $100.

- Safe. You can safely buy and manage Treasury savings options online through the Treasury Department's secure TreasuryDirect web-based system.

- Convenient. You can buy Treasury securities online, 24/7—no more waiting in line. You also can purchase savings bonds or other Treasury securities automatically through payroll direct deposit.

Get Ready to Save and Grow your savings and gain control over your future.

About Savings Bonds

Treasury Securities Options

Learn more about the Gift of Savings Bonds

How to Buy Digital Savings Bonds as Gifts (You Tube video)

Another great time to save with U.S. Savings Bonds is at Tax Time! U.S. Savings Bonds are one safe and easy way to do it.

There are a lot of great reasons to buy U.S. Savings Bonds at tax time.

- You do not need a lot to get started — start with as little as $50. Use just part of your tax refund to start saving.

- It is simple at tax time. Just select the amount you want saved from your income tax refund and you’ll receive your bond in the mail.

- Earn interest. Your money starts growing immediately.

- Bonds are safe. Bonds will never lose value and they are backed by the U.S. Government.

- No fees. There are no fees to buy or cash in your bond.

- Money for the future. You help your loved ones live their dreams when you buy bonds.

- Gift savings to your loved ones. Bonds can be purchased in someone else’s name – so you can help jumpstart the savings and dreams of the people you care about.

What are tax time bonds?

Tax Time Savings Bonds are Series I U.S. Savings Bonds. Issued and guaranteed by the U.S. Treasury Department, Tax Time Savings Bonds can be purchased directly on your tax form. You can cash in your bond after one year at most banks or credit unions, but the longer your keep it the more it will grow in value. Your bond will earn interest for up to 30 years. If you cash your bond within 5 years, you’ll lose the last three months of interest.

The current interest rate on Series I Savings Bonds is 3.1% through April 30, 2012, and will adjust for inflation every six months. Bonds offer competitive returns in comparison with other savings vehicles.*

Growth on your bonds is guaranteed! Bonds make saving safe, simple and secure.

Visit www.bondsmakeiteasy.org

Connect on FB http://www.facebook.com/bondsmakeiteasy

Connect on Twitter https://twitter.com/bondsmakeiteasy

Take the Military Saves Pledge

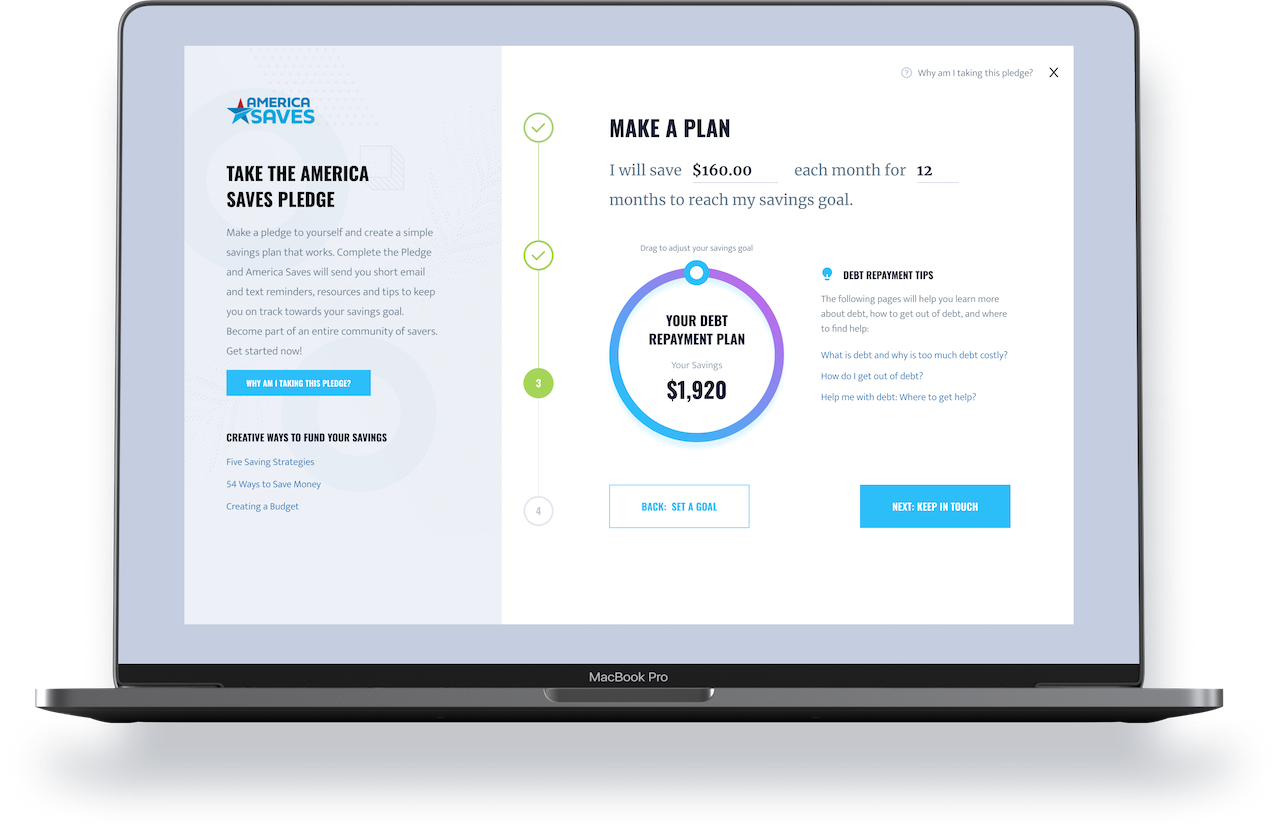

Want inspiration and motivation on your savings journey? Take the Military Saves Pledge today and create a simple personal savings plan that works!

Take the Veteran Saves Pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now! Please use a CIVILIAN email address.

Creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Veteran Saves Pledge is a pledge to yourself to start a savings journey and Veteran Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Veteran Saves will be right beside you the whole way! You will soon receive an email from the America Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

General - Create Goals

Develop a long-term plan for financial readiness by creating financial goals and striving for milestones. Positive outcomes usually start with a goal and a vision. http://ow.ly/sCvQQ

Check out savings journeys from savers just like you

How Smart Financial Decisions Can Create Opportunities

11.22.2019 By Stephen Ross, America Saves Program Coordinator

Making Saving Automatic Leads to Personal Success

05.27.2020

Ryan’s savings journey started when he was an active duty airman. Frequent deployments and temporary duty...

Building a Six-Figure Savings While Enjoying Life

11.13.2020

Does the idea of saving up hundreds of thousands of dollars seem impossible? How about doing it while sti...

Involving Kids in Family Finances

04.19.2019

One of the best lessons we can share with our kids is about money. By middle school, kids should have a g...

When You Start Small, Saving is Easy

08.12.2019

When Attiyya first got married, she and her Marine husband had just graduated from college and were focus...

or

If we feature you in our newsletter, you get $50.