Do You Really Know the Score? Three Important Credit Tips

Do you really understand your credit score? A recent by Consumer Federation of America (our parent organization) and VantageScore Solutions suggests that most people think they know more than they do. The 9 annual survey showed that while more consumers (55%) had recently checked their credit scores than in past years, fundamental knowledge of credit scoring went down by 10-20% since the first survey in 2012.

Related Topics

Do you really understand your credit score? A recent survey by Consumer Federation of America (our parent organization) and VantageScore Solutions suggests that most people think they know more than they do. The 9th annual survey showed that while more consumers (55%) had recently checked their credit scores than in past years, fundamental knowledge of credit scoring went down by 10-20% since the first survey in 2012.

Areas where consumers showed the largest decline in correct answers included:

- Knowing that a low credit card balance helps raise a low score or maintains a high one (85% answered this correctly in 2012, only 66% of respondents got it right in 2019)

- Realizing that opening several accounts at once can affect a credit score (83% in 2012 versus 62% in 2019)

- Recognizing that consumers have more than one credit score (78% in 2012, 62% in 2019).

While the average American’s credit score has gone up to around 680 according to credit bureau Experian, many people do not realize that fair or poor scores can impact every aspect of their lives.

Here are some important credit tips:

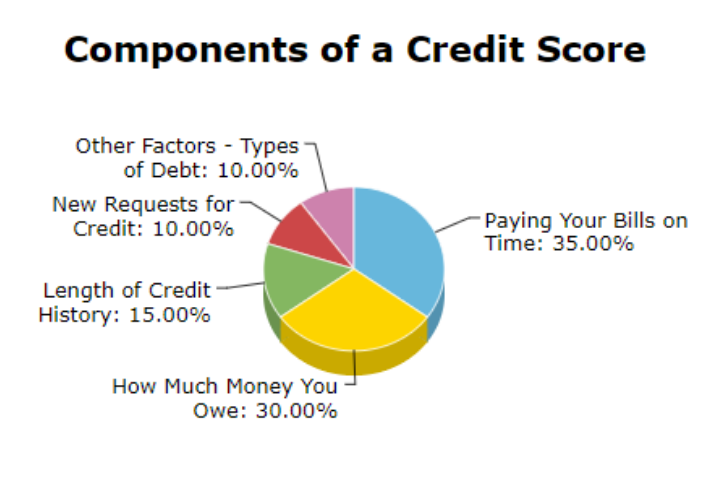

Pay Your Bills on Time – pay at least the minimum amount by the due date. Paying even a day late can impact your credit score, and the late payment will stay on your credit report for seven years! The good news is that even if you miss a payment, every subsequent on time payment helps your score improve.

Pay Down Your Credit Cards – The amount of debt you carry on your credit cards is the second most important factor in determining your credit score. Keep your debt to credit ratio low, ideally below 30%. For example, if your credit card has a $10,000 limit, and you are carrying a $5,000 balance, then you have used 50% of your available credit.

Don’t Apply for Credit You Don’t Need – As tempting as a free gift or a percentage off on your purchase might seem, don’t apply for lines of credit that you don’t need because every time you apply for credit is counted as a “hard” inquiry that will impact your credit score. Checking your own credit score, however, is a “soft” inquiry that will not affect your score.

Credit scores not only affect the interest rate on loans and credit cards, they can also impact your insurance premiums, your utility deposits, your rental applications, and perhaps most importantly, your security clearance.

Service members who take the Military Saves Pledge can get a free FICO credit score courtesy of the FINRA Foundation. Installation family readiness centers also have Personal Financial Managers and Counselors who can assist with pulling and interpreting credit scores.