5 Things to Ask Yourself Before You Spend Your Stimulus Check

For years, has been advocating that savers should have a plan for their money. The stimulus check (technically called the Economic Impact Payment) that many Americans are receiving right now is no different. But these are turbulent times, and we are in uncharted waters. Before you make any decisions about spending, you should consider these points.

For years, Military Saves has been advocating that savers should have a plan for their money. The stimulus check (technically called the Economic Impact Payment) that many Americans are receiving right now is no different. But these are turbulent times, and we are in uncharted waters. Before you make any decisions about spending, you should consider these points.

- Can I cover the basics?

Food, shelter, medicines, transportation. These are all basic needs. Assess whether you can cover these before proceeding further with your spending plan.

While the federal government has provided some relief in the form of forbearance on payments for federally backed mortgages, there is little to protect renters and non-federal mortgage holders other than the protection from eviction that the CARES Act offers. Some local and state governments have provided further relief, but it varies by location. And it’s important to note that forbearance simply puts off the payment until a later date.

- Can I make minimum payments on debts?

If you have credit card payments or car loans, you will still have payments due. If you don’t want your credit score (and your security clearance) to take a hit, you will still need to meet those monthly minimums.

If you have a federal student loan, you will not accrue interest and have the option to put the loan in forbearance. Private loans may still require payments. As always, if you think you will not be able to make minimum debt payments on time, you should contact your lender. Many creditors have more lenient policies in light of the pandemic.

- Do I have a large enough emergency fund?

Maybe you’ve had to dip into your emergency fund these past few weeks. Or maybe your emergency fund isn’t as large as you want it to be. Regardless, the stimulus check may be a great way to jump-start your emergency savings.

Keep in mind that your emergency fund should be in an FDIC (or NCUA) insured account at a financial institution. It should be easy to access, but ideally in a separate account, not in your main checking account.

- Do I want to keep contributing to my retirement accounts?

While looking at your TSP and other retirement accounts is a bit scary these days, it can make sense to continue to invest in a down market because you are, in effect, getting stocks and funds on “sale” at a low price. But it also can be frightening to tie up your funds in retirement accounts when you don’t know whether you will need that money sooner than retirement age.

Fortunately, the recently-passed CARES act allows you to pull out funds from qualified retirement accounts if you’ve been impacted by COVID-19. You will have to pay taxes on what you take out, but there are no early withdrawal penalties. You then have three years to pay back the withdrawals.

While I don’t typically recommend “robbing” one’s retirement, the new provisions do give some peace of mind to those on the fence about continuing to save for retirement.

- Do I want to pay down debt or pursue other savings goals?

If you feel that you have an adequate emergency fund, can meet all day-to-day expenses, and can make minimum debt payments, then you might consider other savings goals, such as paying down debt or saving for education. However, it is important to note that in a volatile economic situation, you might want to keep some of your stimulus check in your savings account so that you can have flexibility in the future.

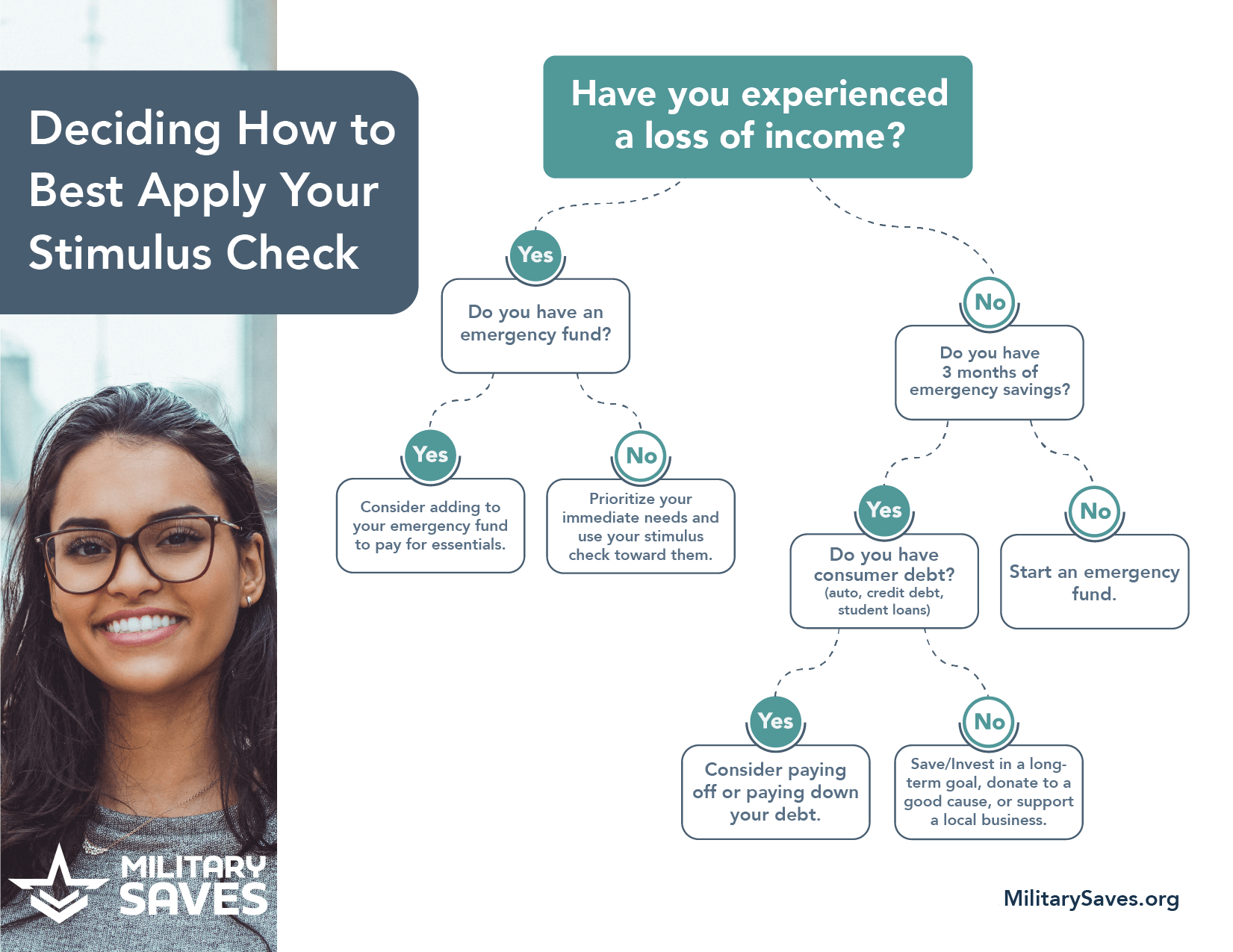

To further help you decide how to apply your stimulus check based on your unique situation, work through our decision tree.

Want inspiration and motivation on your savings journey? Take the Military Saves Pledge today and create a simple personal savings plan that works!