Saving at Tax Time

Do you spend weeks eagerly anticipating your tax refund? When the money finally comes in, is it gone tomorrow? Many people view tax refunds as unplanned bonuses. They see the money as a gift from the government, to use for splurges or treats. A tax refund provides the opportunity to improve your financial situation.

Tips to Get the Most Value from Your Tax Refund

- Pay down your debt. Use your refund for some much needed debt relief. Pay off your credit card balance. If you have an outstanding balance on more than one credit card, try to pay off the smaller, high-interest rate balances first. That will free up more funds to put toward larger balances. Alternatively, you can apply your refund toward other debts, like a car loan or a home equity loan.

- Save for a rainy day. Why not give yourself an even bigger return on your tax refund by putting the money into a savings account, CD, or retirement fund? Your tax refund will continue to grow if you put it into savings or invest the money. It's always helpful to have a savings account to draw from when a major car repair bill, medical emergency or other unexpected expense comes along. That way, you don't have to borrow money and add to your debt-load.

- Consider your financial goals. Trying to save for a house or car down payment? Hope to contribute to your child's college tuition? Consider applying your tax refund toward these goals. If you don't yet have a set of short-term and long-term financial goals, put one together. You'll be more conscientious about how you spend your refund or any other extra money that comes your way.

Remember, you work hard for your money and you deserve to enjoy a healthy financial lifestyle. Put some thought into how you use your tax refund. Making smart financial decisions is not always easy, but it will definitely benefit you and your family over the long term.

Tax Time Savings Bonds

Tax Time is a great time to kickstart or grow your savings for the future! U.S. Savings Bonds are one safe and easy way to do it.

There are a lot of great reasons to buy U.S. Savings Bonds at tax time.

- You do not need a lot to get started — start with as little as $50. Use just part of your tax refund to start saving.

- It is simple at tax time. Just select the amount you want saved from your income tax refund and you’ll receive your bond in the mail.

- Earn interest. Your money starts growing immediately.

- Bonds are safe. Bonds will never lose value and they are backed by the U.S. Government.

- No fees. There are no fees to buy or cash in your bond.

- Money for the future. You help your loved ones live their dreams when you buy bonds.

- Gift savings to your loved ones. Bonds can be purchased in someone else’s name – so you can help jumpstart the savings and dreams of the people you care about.

What are tax time bonds?

Tax Time Savings Bonds are Series I U.S. Savings Bonds. Issued and guaranteed by the U.S. Treasury Department, Tax Time Savings Bonds can be purchased directly on your tax form. You can cash in your bond after one year at most banks or credit unions, but the longer your keep it the more it will grow in value. Your bond will earn interest for up to 30 years. If you cash your bond within 5 years, you’ll lose the last three months of interest.

Growth on your bonds is guaranteed! Bonds make saving safe, simple and secure.

To learn more visit www.bondsmakeiteasy.org

Connect on FB http://www.facebook.com/bondsmakeiteasy

Connect on Twitter https://twitter.com/#!/bondsmakeiteasy

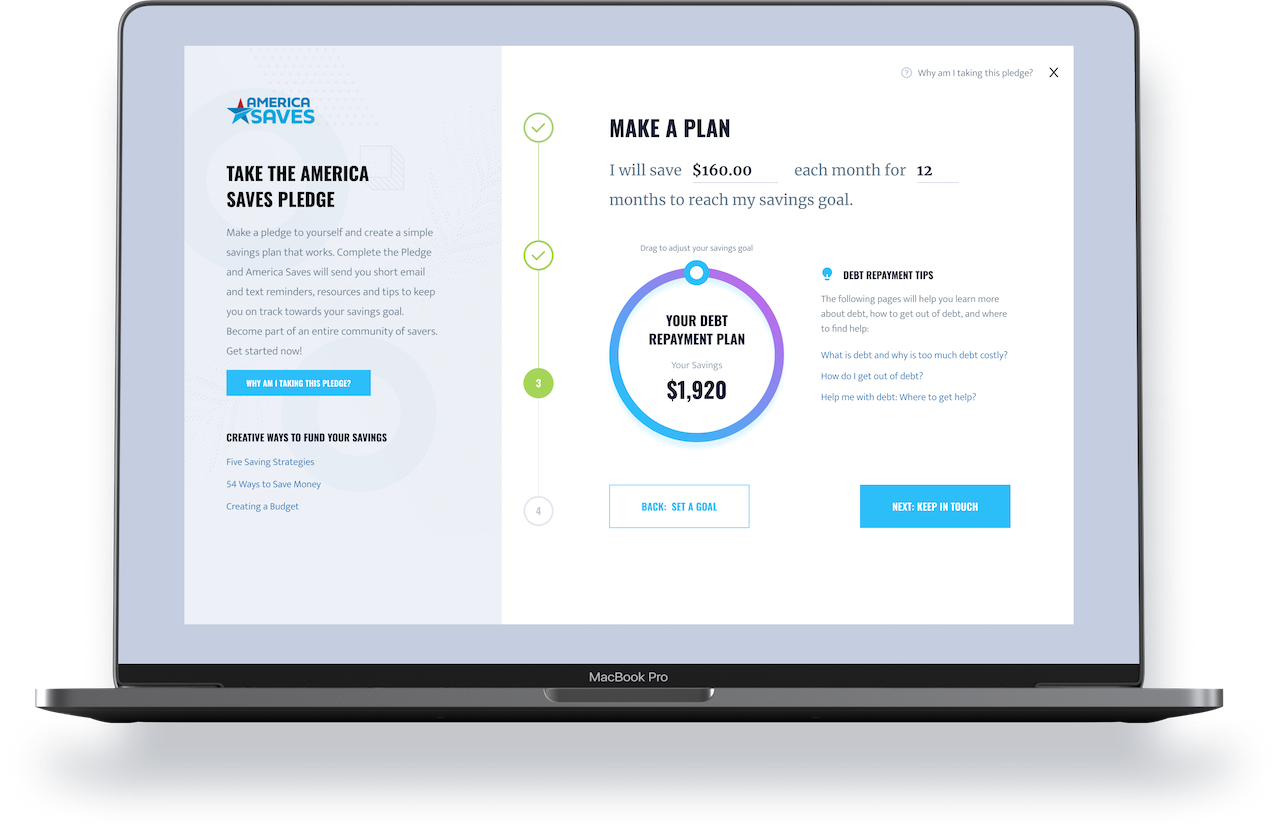

Take the Military Saves Pledge

Want inspiration and motivation on your savings journey? Take the Military Saves Pledge today and create a simple personal savings plan that works!

Take the Veteran Saves Pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now! Please use a CIVILIAN email address.

Creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Veteran Saves Pledge is a pledge to yourself to start a savings journey and Veteran Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Veteran Saves will be right beside you the whole way! You will soon receive an email from the America Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

General - TSP

The Thrift Savings Plan (TSP) offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans. Sign up or get more info at tsp.gov

Check out savings journeys from savers just like you

Setting a Goal Leads to Success

05.24.2019

Growing up, Marisa’s dad had always talked about saving first, but she said she didn’t really internalize it until much later. “I was drifting along with no plan, carrying a little bit of revolving debt, saving some money here and there, but without a real plan for it.”

How Smart Financial Decisions Can Create Opportunities

11.22.2019 By Stephen Ross, America Saves Program Coordinator

Building a Six-Figure Savings While Enjoying Life

11.13.2020

Does the idea of saving up hundreds of thousands of dollars seem impossible? How about doing it while sti...

From Shopaholic to Saver

01.13.2021

Many of us spend too much money on things we don’t need, but we don’t always know why. It’s easy to get a...

When You Start Small, Saving is Easy

08.12.2019

When Attiyya first got married, she and her Marine husband had just graduated from college and were focus...

or

If we feature you in our newsletter, you get $50.